Posted February 16, 2023 — Contributed By Lisa Haberman, MBA, MAM, ChFC, CLU, Ascensus

Many people intent on keeping their financial house in order have taken advantage of the window of opportunity at age 50 to start making catch-up contributions into their retirement accounts. If this applies to some of your clients, they’ll be happy to hear that SECURE 2.0 has now opened a new window, allowing eligible retirement plan participants and IRA owners to make larger catch-up contributions.

Retirement Plan Limits

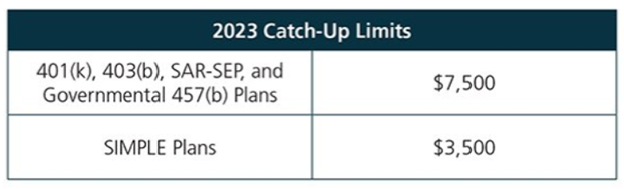

Current regulations permit individuals who are age 50 or older to contribute amounts to retirement plans in excess of the otherwise applicable contribution limits. The amount of the catch-up contribution depends on the type of retirement plan.

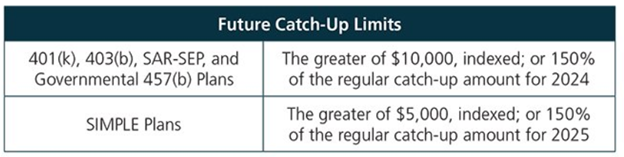

SECURE 2.0 will permit participants who attain age 60, 61, 62, and 63 to make additional catch-up salary deferral contributions to their retirement plans. Similar to the current limits, the amount of the catch-up contribution will depend on the type of retirement plan. The higher catch-up contribution limits will be indexed, effective for years beginning after December 31, 2025.

IRA Limits

Traditional and Roth IRA owners age 50 and older can also make catch-up contributions up to the fixed amount of $1,000. Starting in 2024, the fixed amount for catch-up contributions will be indexed in multiples of $100—similar to the existing indexing of the regular Traditional and Roth IRA contribution limits.

SECURE 2.0 Technical Error

It is important to note that SECURE 2.0 was passed with a technical error. Subparagraph (C) of IRC Sec. 402(g)(1) was stricken in the “Conforming Amendments” portion of Section 603. This subparagraph generally authorizes the ability to make catch-up contributions; but because this section was deleted from SECURE 2.0, the tax code technically will not permit catch-up contributions beginning in 2024. This clearly was not Congress’s intention. It is possible that Congress may pass a technical amendment to SECURE 2.0 (along with other corrective amendments), but the timing of such a measure is uncertain. It is also possible that the IRS may decline to enforce certain Internal Revenue Code provisions in the interest of fairness or to resolve statutory ambiguity. It is unclear at this time what option the IRS may take in regard to this technical error; however, it appears that catch-up contributions will remain an option for individuals interested in shoring up the financial foundation of their retirement.