By Jim Jumpe

Senior Vice President and Chief Marketing Officer

Arch MI

How big is the Hispanic housing market in your region?

Earlier this year, forecasters at The Urban Institute predicted that the Hispanic population will account for 70% of new U.S. homeownership growth between 2020 and 2040, across all states.

In 2020, more than 600,000 Latinos in the United States purchased a home— up 13% over 2019, according to an annual report by the National Association of Hispanic Real Estate Professionals (NAHREP). (For detailed stats on Hispanic homeownership in the Midwest region where FIPCO is headquartered and operates, see NAHREP’s informative one pager for these states, including Illinois, Michigan, Minnesota and Wisconsin, where Hispanic population growth and homeownership grew significantly.)

There are 8.3 million “mortgage-ready” Hispanics aged 45 and under with credit characteristics that potentially allow them to qualify for a mortgage, NAHREP’s researchers determined.

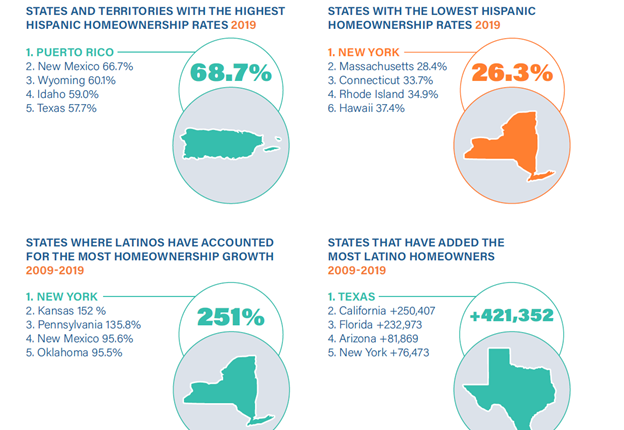

While a significant gap in homeownership rates exists between Hispanics and the general population, the gap is shrinking. The Hispanic homeownership rate increased in 2020 for the sixth year in a row, the only demographic that can claim this positive record.

Source: NAHREP 2020 State of Hispanic Homeownership Report, April 2021

For mortgage lenders, Hispanic clients unite the concerns of most first-time homebuyers with the specific needs of their demographic:

- According to NerdWallet.com, as many as three-fifths of all prospective homebuyers think a 20% down payment is required. Lenders can correct this misperception and explain how loan programs can accommodate much smaller down payments.

- As first-time buyers and, in many cases, first- or second-generation immigrants, some Hispanic homebuyers may not be knowledgeable about down payment options, according to mortgageloan.com’s “Guide to Housing and Mortgages for Hispanics.” Many prospective first-time buyers may be unfamiliar with the increasing use of gift funds by first-time homeowners. This is an opportunity for lenders to educate their customers using social media and hosting homebuying seminars.

- Whether in person or via apps like Zoom, homebuying seminars are a powerful way for originators to connect with homebuyers. Arch MI offers LOs a Roadmap to Homeownership, a comprehensive educational package to help you guide first-time homebuyers through the homebuying process, including information on credit, financing, taxes, etc. and handy checklists for borrowers.

Recently, Arch MI published a Spanish version of our brief “What Is MI” video. Less than two minutes long, the video provides a way for originators to give clients a quick overview of the options mortgage insurance provides to qualified homebuyers.

This article originally appeared in Arch MI’s Insights blog, which presents expert commentary on challenges and opportunities for mortgage loan originators. Bookmark insights.archmi.com for all of our posts on mortgage-related topics.